Money transfer apps, also known as peer-to-peer (P2P) money transfer applications, allow you to send money from person to person or entity to entity fast, easily, cheaply, and securely. They facilitate payments by allowing you to link your credit card or bank account through a digital wallet. Electronic transactions and payments can be completed with a few clicks on a mobile device. It’s important for you to do research on each money transfer to have a safe transaction. You can read detailed app reviews on Techpotamus to clear your doubts about apps. You will be able to choose the best app to use.

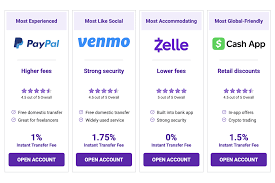

The top money transfer applications have great app store ratings, assist app shoppers in sending money safely, and have no hidden fees. They also cater to consumer needs such as foreign payments, social choices, virtual wallet solutions, and so on. Here is the list of 5 best and most popular money transfer apps that you can trust:

PayPal

PayPal’s diverse, versatile, flexible, secure, and user-friendly money transfer features to set it apart from the competition. You can send money from your PayPal balance, bank account, or Amex Send account for free. You can also use PayPal Instant Send to transfer funds immediately for a charge.

PayPal’s app is available for iOS, Android, and Windows. It only takes a few minutes to download and move money from one person to another. For a quick and safe payment option, you can share PayPal.Me link. You may also customize and track each invoice you send using PayPal’s invoice-generating feature.

You can send up to $60,000, but depending on the currency you pick, PayPal may limit the transaction to $10,000. If you transfer money to the wrong person by mistake, you can contact the contact and request a refund. If the person does not answer, you can file a dispute using PayPal’s Resolution Center.

With the PayPal Cash Card, a debit card with a daily spending limit of $3,000 and a daily cash ATM withdrawal limit of $400 with a maximum of 30 transactions per day, you can use your PayPal balance to maintain money in your account.

WorldRemit

The WorldRemit app won this category because it has no hidden fees and allows you to send money to over 130 countries.

Money can be sent to recipients in minutes with WorldRemit. Most transactions are completed within 24 hours, regardless of where the beneficiaries live on the planet. When you refer a friend to WorldRemit, you both receive a coupon for your next transfer. In addition, new clients can use the discount code 3Free to make their first three transfers fee-free.

The app allows you to send money in a variety of ways, including cash pickup, bank transfer, mobile money, home delivery, and airtime top-up, which is why it scored in our top category.

WorldRemit accepts most Visa and Mastercard debit, credit, and prepaid cards. WorldRemit accepts payments through Klarna, Trustly, POLi, Apple Pay, and other providers. Google Pay is no longer accepted.

You can easily send money through World Remit iOS or Android app. Choose the nation and amount to send, then enter the recipient’s information and bank information. After you pay for the transaction, your recipient will be notified by SMS and email when they will be able to access their funds.

Cash App

Cash App, which is owned by Square Inc., ranked first in the low costs category since it allows users to send money instantaneously via mobile app for free. Cash App distinguishes itself through its simplicity (you either pay or get paid), ease of use, and lack of costs.

Cash App also provides unique features not found in other money transfer apps, such as investing possibilities, special savings with “cash boosts,” and the ability to buy and sell bitcoin.

Cash App was chosen due to its low costs and flexibility, which includes the ability to buy and sell bitcoin directly from your Cash App balance.

You can also transfer monies from your Cash App account to a bank account or store money in your Cash App account. On the app’s home screen, tap the “Balance” tab, then “Cash out,” enter the amount, then select whether you want to request or pay money. Enter the other person’s $Cashtag, phone number, or email address and tap “pay” to send a payment.

Venmo

Venmo combines the best of both worlds by providing a quick and easy means to transfer and receive money as well as a potential “parking spot” for your money. Venmo money can be spent, sent, or transferred to your bank account. It won the category for shared expenses for these reasons.

You can make your transactions more interactive by including emoticons or animated stickers.

PayPal’s Venmo dominated this category because it enables quick and easy money transfers between individuals. You can send and receive money for free using the peer-to-peer payment app, however, sending money using a credit card costs 1.75% of the entire transfer amount.

Venmo also charges a 1.75% fee ($0.25 minimum and $25 maximum) for quick bank account transactions. You can store money in your Venmo or bank account.

You can send money using your iPhone or Android smartphone by selecting a sign-up option and generating a secure password of eight to twenty characters. Venmo requests that you confirm your phone number, email address, and bank account.

Facebook Pay

Facebook Pay won the prize for its simplicity in sending modest sums of money over a familiar network. In certain countries, you may use Facebook Pay to make smooth and secure payments using Meta Messenger, WhatsApp, Portal, and Instagram.

Facebook Pay beat out the competition in this area because it allows you to send money or give to causes you care about in just a few steps:

- Message the recipient.

- Tap the money icon, then enter the amount you want to send.

- Recipients can then tap “pay.” Facebook Pay will lead recipients through the process with specific instructions if they don’t have an account.

Facebook Pay does not indicate transaction limits, although Messenger does, depending on the form of payment used, limit transactions to $10,000. Users can fund payments with a credit card from Visa, AMEX, Discover, MasterCard, or JCB, or a debit card from Visa, AMEX, or Discover. PayPal accounts are also welcome. Citizens of the United States who are 18 or older may send money to trustworthy friends and family.

Conclusion

Your final choice for the best money transfer app is determined by your aims and preferences. For example, if you want your app to have other capabilities (such as bitcoin investment), look for Cash App, which has them.

However, for a comprehensive overall money transfer software, you can’t go wrong with PayPal, which provides a variety of payment alternatives as well as a proven track record. PayPal also takes the lead thanks to its security features, payment protection, and useful business tools.