It also removes tax increases for businesses and wealthy Americans to pay for packages.

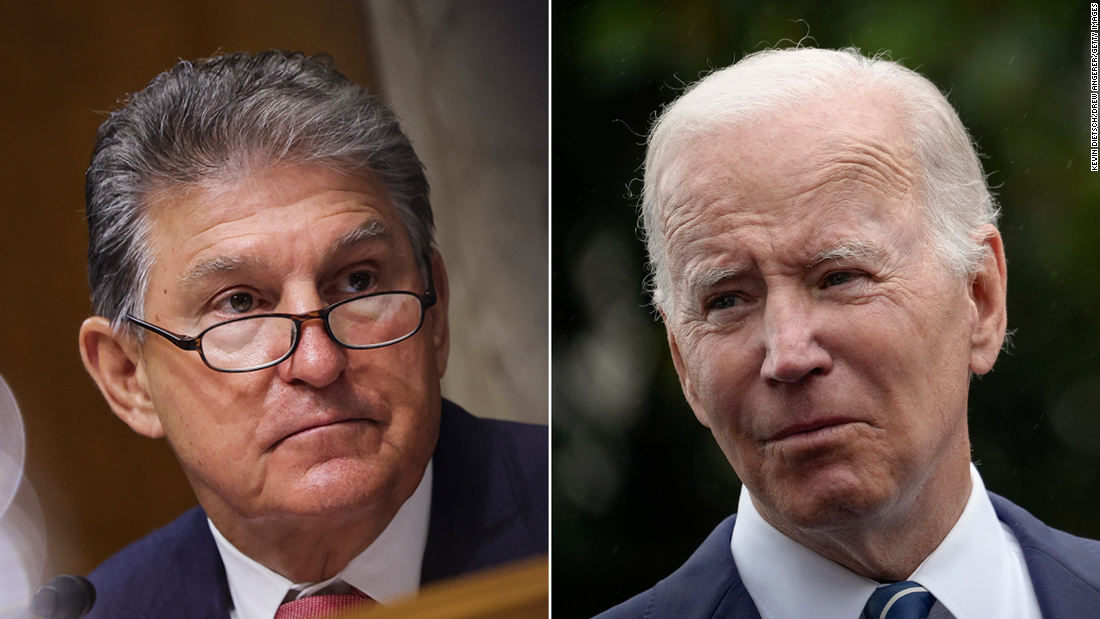

Manchin has announced that he will accept drug prices and Obamacare subsidies. This suggests that all Democrats are likely to enter a package that could pass Congress this year.

This is what could be included in the current transaction:

Senate leaders have already drafted a bill for drug pricing and sent it to MPs. Parliamentarians are needed for the bill to go through settlement, and only a majority of the senators need to pass. She hasn’t announced her decision yet.

The Office of Management and Budget also scored drug price measurements, stating that it would reduce the federal deficit by $ 288 billion over a decade.

Medicare drug price negotiations: The bill empowers Medicare to negotiate the prices of certain expensive medicines given in the clinic or purchased at pharmacies. The Secretary of Health will negotiate prices for 10 medicines in 2026 and an additional 15 medicines in 2027 and 2028. The number will increase to 20 drugs per year after 2029.

This controversial provision is far more restricted than what House Democratic leaders have endorsed in the past. But that will open the door to achieving the long-standing party’s goal of allowing Medicare to use its burden to lower drug costs.

Inflation cap: The law will also impose penalties if pharmaceutical companies raise prices faster than inflation.

Medicare Out-of-pocket Cost Limits: The bill will redesign Medicare’s Part D medicine plan to prevent older people and people with disabilities from paying more than $ 2,000 a year for medicines purchased at pharmacies. Insurance and pharmaceutical companies need to get more tabs.

Free vaccines for the elderly: Medicare subscribers can get All vaccines are free. Currently, only certain vaccines such as Covid-19, flu and pneumonia are free.

Affordable Care Law Grants: The Democratic Party is also considering expanding enhanced federal premium subsidies to Obamacare’s coverage until 2025.

Registrants only pay 8.5% of their income to cover, which reduces from nearly 10%. In addition, low-income policyholders receive subsidies that completely eliminate premiums.

Also, those who earn more than 400% of the federal poverty level were the first to receive assistance.

According to the Kaiser Family Foundation, nearly all 13 million subsidized registrants expect premiums to rise in 2023 if enhanced federal support is allowed to expire at the end of the year. According to an analysis by the Urban Institute, more than 3 million people could be uninsured.

The Democratic Party wants to avoid negative publicity of such premium increases. If Congress doesn’t act, consumers will learn how much more they have to pay in the fall. General registration will begin on November 1st, one week before the election date.

According to the CBO, a version of this provision to extend the Obamacare subsidy included in the House bill last year cost $ 74 billion.

The ones that are likely to be omitted are:

Tax provisions: House bill It included a combination of tax increases for businesses and wealthy individuals to help pay for new spending. This includes an additional 5% tax on personal income over $ 10 million and an additional 3% tax on income over $ 25 million. It also includes a minimum tax of 15% on corporate profits that certain large companies report to shareholders but not to the Internal Revenue Service.

Overall, by 2022, nearly 40% of households would have received tax cuts and nearly 19% would have paid more taxes than they do today, according to the analysis.

Expanding Medicare solvency: The Senate Democratic Party said last week that it had signed a deal to extend Medicare’s solvency for several years by closing tax loopholes. This proposal will ensure that the owner of a particular “pass-through” business that includes business income in an individual tax return pays a net investment income tax of 3.8%. This applies to individuals with an annual income of $ 400,000 or more and co-filers with an annual income of $ 500,000 or more.

However, the agreement was also terminated by Manchin this week.

Cheaper insulin: The House bill would also limit the amount Americans pay for insulin for $ 35 a month.Another bipartisan effort to put limits on insulin prices is still being negotiated in the Senate, but that measure has been removed...

Climate change: The House bill would have provided about $ 570 billion in tax credits and investments aimed at combating climate change. For example, they would have offered tax credits to families who installed solar rooftops or bought electric cars. The investment was aimed at providing incentives to grow the domestic supply chain in the solar and wind industries.

Legislation is also called For creating 300,000 jobs by establishing a private climate corps that works to protect public land and strengthen the resilience of communities.

Universal pre-K and lower childcare costs: The House bill provided free pre-kindergarten for children aged 3 and 4 and expanded access to 6 million children annually. In addition, childcare costs for families with children under the age of 6 are limited to less than 7% of income for incomes up to 250% of the state’s median income, expanding access to approximately 20 million children. increase. Funding for these programs lasted for six years and cost an estimated $ 381.5 billion, according to the CBO.

Previous enhancements that were part of the Coronavirus Relief Package, It was implemented only in 2021.

Household heads with an annual income of up to $ 112,500 and co-filers with an annual income of up to $ 150,000 are eligible for fully enhanced credit. But unlike 2021, only these families would have been funded in monthly installments this year. High-income qualified parents would have had to claim credit on their tax returns next year.

Credits are permanently refundable, so low-income families will continue to qualify.

According to the company, this credit will cost about $ 203 billion, including the earned income tax credit. CBO.

Earned income tax credit: Expanded earned income tax credit, which was also part of the coronavirus relief package, It would have been extended to 2022 and helped 17 million low-paying childless workers.

The House bill would have nearly tripled the maximum credit that childless workers could receive, expanded their qualifications to more people, reduced the minimum age, and lifted the age limit. According to the CBO, this credit will cost about $ 203 billion, along with an enhanced child tax credit.

Home medical care: Biden’s original plan is to permanently improve Medicaid’s coverage of home care services for the elderly and disabled with the goal of reducing more than 800,000 people on the state’s Medicaid waiting list. I was looking for it.

The plan was also aimed at improving the quality of long-term care work. According to the CBO, this measure will cost about $ 158 billion.

Affordable Housing: The law should have invested $ 25 billion in building, rehabilitating, buying, and creating and preserving affordable rental homes for low-income earners.It would have provided and strengthened $ 65 billion to address the unprocessed portion of public housing capital needs. Rental support for hundreds of thousands of families.

The bill would also have invested in down payment support and community-led redevelopment projects in resource-poor areas. And it would have provided $ 24 billion to fund housing vouchers and support services.

According to the CBO, this effort will cost about $ 148.1 billion.

It would have historically invested in black colleges and other institutions serving underrated communities. And it would have increased funding for labor development.

These provisions, in total CBO estimates $ 39.8 billion.

Biden initially also required free tuition for two years at community colleges, but that provision was removed from the house bill.

Medicaid Coverage Gap: The Democratic Party will provide low-income Americans in 12 states who are not expanding their Medicade with a premium subsidy for the Affordable Care Act to enable them to purchase Obamacare insurance without a monthly premium until 2025. I was looking for it.

The CBO estimated that doing so would cost about $ 57 billion.

Medicare Hearing Benefits: Hearing services would have been covered under Medicare since 2023, under a bill that passed the House of Representatives.

According to the White House, only 30% of older people over the age of 70 who can benefit from hearing aids have used hearing aids.

According to the CBO, this measure will cost $ 36.7 billion.

Source: www.cnn.com