Technical analysis is a formidable tool in the arsenal of traders and investors, serving as a navigational compass in the turbulent waters of financial markets. Among its most critical components lies chart analysis—a skill that enables individuals to decipher intricate patterns and trends, predicting future price movements. In this comprehensive exploration, we will embark on a journey into the world of technical analysis, focusing on the pivotal role of Chartanalyse lernen and the profound impact it has on market decision-making.

Chart Analysis: The Pillar of Technical Analysis

At the heart of technical analysis beats the concept of chart analysis. This intricate process involves scrutinizing price charts to extract valuable insights about the past behavior of assets. Traders employ an array of chart types, such as line charts, bar charts, and candlestick charts, to visualize price fluctuations across diverse timeframes. Through this analytical lens, patterns and trends emerge, revealing a dynamic tapestry of historical price movements that traders can use to inform their trading strategies.

Learning Chart Analysis: Navigating Key Concepts and Techniques

Trends:

Grasping the ebb and flow of trends is the bedrock of chart analysis. A trend is the prevailing direction that an asset’s price traverses. Three archetypes dominate this landscape: uptrends (characterized by higher highs and higher lows), downtrends (marked by lower highs and lower lows), and sideways trends (displaying relatively flat price trajectories). Discerning trends is invaluable, as they unveil potential entry and exit points for traders.

Support and Resistance:

The concepts of support and resistance form crucial cornerstones in technical analysis. Support levels denote price thresholds where asset declines tend to halt, and rebounds often ensue. Conversely, resistance levels signify price thresholds where ascents come to a halt. Recognizing these levels empowers traders to implement stop-loss orders and strategically target prices.

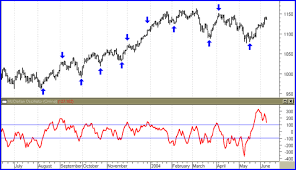

Chart Patterns:

Chart patterns—distinctive formations etched within the charts—hold a wealth of predictive potential. Patterns like head and shoulders, double tops, double bottoms, and triangles provide insights into forthcoming price movements. By identifying and decoding these patterns, traders gain the ability to predict potential breakout or breakdown junctures.

Candlestick Patterns:

Introducing a visual narrative to price data, candlestick charts epitomize elegance. These visual representations encapsulate patterns like doji, engulfing patterns, and hammers, each of which sheds light on market sentiment and potential reversals.

Indicators and Oscillators:

The toolbox of a technical analyst brims with indicators and oscillators that complement chart analysis. The armory includes moving averages, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands. These tools facilitate trend validation, momentum evaluation, and the detection of overbought or oversold conditions.

The Merits of Chart Analysis Mastery

Informed Decision-Making:

A profound Chartanalyse lernen equips traders with a treasure trove of historical price wisdom. Armed with this knowledge, traders can foster discernment in their decision-making processes, thus elevating their prospects of success in the competitive marketplace.

Spotting Opportunities:

Adept chart analysis cultivates the ability to identify nascent trading prospects, allowing traders to harness early market movements and reap rewards from the timely recognition of opportunities.

Risk Management:

Chart analysis empowers traders to craft judicious risk management strategies. Armed with insights from patterns, trends, and indicators, traders can set appropriate stop-loss and take-profit levels, curbing potential losses while optimizing gains.

Price Movement Prediction:

While crystal balls are the stuff of fantasy, technical analysis, notably chart analysis, lends a structured approach to prognosticating price movements. Rooted in historical patterns, this methodology affords traders a navigational compass in deciphering the intricate language of market trends.

Conclusion

Chartanalyse lernen emerges as a quintessential skill within the realm of technical analysis, unfurling the panorama of historical price movements, trends, and nascent market dynamics. By mastering this skill, traders metamorphose into informed decision-makers, adept at seizing opportunities, managing risks, and embracing a deeper comprehension of market intricacies. In the vast ocean of financial markets, chart analysis stands as a lighthouse, guiding traders toward strategic decisions that can shape their trading destiny.